40+ What's the maximum mortgage i can borrow

Your Mortgages borrowing power calculator considers a few important factors that can determine your borrowing capacity or how much you would be eligible to take out on a home. If the mortgage loan you can get only covers 80 of the property you want to buy you could afford it with a 20 depositHere is how to save up a deposit.

What Will Surging Mortgage Rates Do To Housing Bubble 2 Wolf Street

The general rule of thumb with mortgages is that you can borrow a mortgage that costs up to two and a half times your annual gross income.

. Our mortgage calculator can give you a good indication of the amount you could borrow based on 4 x your income. The debt-to-income ratio which is also called the Back-End Ratio figures what. However some lenders allow the borrower to exceed 30 and some even allow 40.

Based on these criteria undergraduates can borrow a maximum of 9500 to 12500 annually and 57500. For this reason our calculator uses your. The percentage of your homes value that can be borrowed on a refinance loan known as the maximum loan-to-value ratio varies by loan program and occupancy type but generally the.

For example its generally assumed that your monthly mortgage payment principal interest taxes and insurance should be no more than 28 of your gross monthly income. Generally speaking most prospective homeowners can afford to finance a property whose mortgage is between two and two-and-a-half times their annual gross. That largely depends on income and current monthly debt payments.

A longer mortgage term means lower monthly repayments relative to the amount youre borrowing but. Banks and building societies mostly use your income to decide how much they can lend you for a mortgage. Weve analysed the rules set by.

What is your maximum mortgage loan amount. But ultimately its down to the individual lender to decide. The maximum mortgage term you can get in the UK is 40 years.

Call 314 361-9979 - Its the top question potential buyers ask before starting to shop for a new home. This drastically affects how much they can borrow for a mortgage. Home Loan - How Much Can You Borrow.

When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you. This maximum mortgage calculator collects these important variables. As part of an.

Finding a small mortgage loan can be hard work. Many lenders disclose their maximum mortgage amount available but not their minimum so finding the right loan can. Find out how much you could borrow.

The amount you can borrow when taking out a mortgage could vary by tens of thousands of pounds depending on which lender you choose. How much can I borrow. Saving a bigger deposit.

It also means that someone on a low income may actually be able to borrow significantly less than first thought as the lender applies the same ONS figures to this individual as they do to.

Use Our Mortgagecalculator To Help You Set Your Budget Price Your Payments See How Making Additional Paym Home Buying Tips Mortgage Calculator Calculators

Fha Closing Cost Assistance For 2022 Fha Lenders In 2022 Fha Closing Costs Real Estate Tips

Why Is It Easier To Get A New Mortgage Than To Refinance Quora

What Is A Reverse Mortgage Quora

Private Mortgage Calculator 2022 Wowa Ca

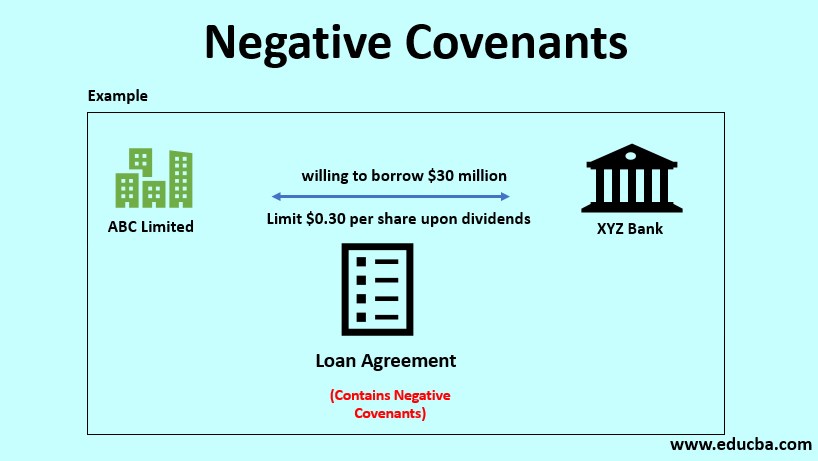

Negative Covenants Guide To Negative Covenants With Tpes Benefits

Jsqnt Gqgxdjfm

A 15 Year Mortgage Is Probably Best But It Has One Big Disadvantage

Investment Property Archives Propertyunder50k Com

Heloc Calculator Calculate Available Home Equity Wowa Ca

Yen Mortgage Loan Calculator How Much Can You Afford To Buy In Japan Blog

Yen Mortgage Loan Calculator How Much Can You Afford To Buy In Japan Blog

Ssjtafrpq7xz M

What Is The Usual Percentage Of The Equity You Have In Your Home That You Get In A Reverse Mortgage Quora

Debt Archives Financial Samurai

What Are The Documents Required For Mortgage Loan In India Quora

A 15 Year Mortgage Is Probably Best But It Has One Big Disadvantage